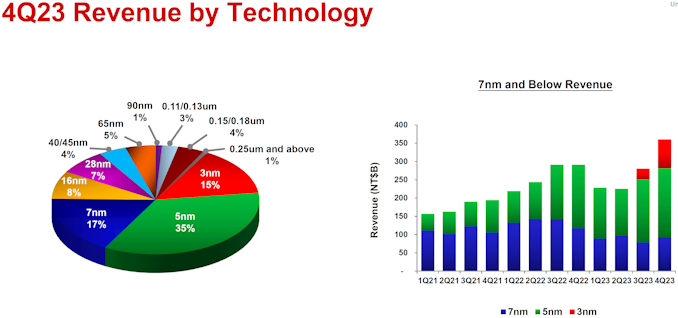

TSMC Posts Q4'23 Earnings: 3nm Revenue Share Jumps to 15%, 5nm Overtakes 7nm For 2023

by Anton Shilov on January 19, 2024 9:00 AM EST- Posted in

- Semiconductors

- Apple

- Financial Results

- TSMC

- 3nm

- N3

- N3E

Taiwan Semiconductor Manufacturing Co. released its Q4'2023 and full year 2023 financial results this week. And along with a look at the financial state of the firm as it enters 2024, the company's earnings info also offers a fresh look at the utilization of their various fab nodes. Of particular interest, with TSMC ramping up production of chips on its N3 (3 nm-class) process technology, N3 (aka N3B) has already reached the point where it accounts for 15% of TSMC's revenue in Q4 2023. This is a very fast – albeit not record fast – revenue ramp.

In the fourth quarter of 2023, sales of wafers processed using N3 accounted for 15% of TSMC's total wafer revenue, whereas revenue of N5 and N7 accounted for 39% and 17% respectively. In terms of dollars, N3 revenue for TSMC was $2.943 billion, N5 sales totaled $6.867 billion, and N7 revenue reached $3.3354 billion. In general, advanced technologies (N7, N5, N3) commanded 67% of TSMC's revenue, whereas the larger grouping of FinFET-based process technologies accounted for 75% of the company's total wafer revenue.

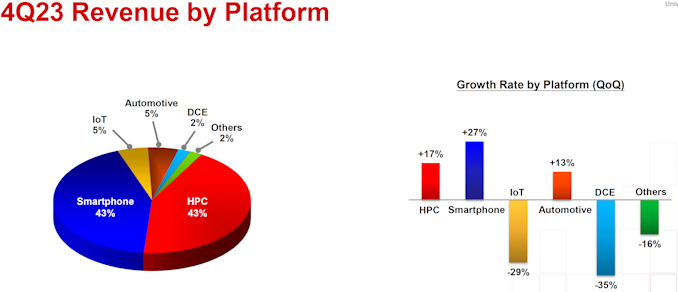

It is noteworthy that revenue share contributions made by system-on-chips (SoCs) for smartphones and high-performance computing (a vague term that TSMC uses to describe everything from game consoles to notebooks and from workstations to datacenter-grade processors) were equal in Q4 2023: 43% each. Automotive chips accounted for 5%, and Internet-of-Things chips contributed another 5%.

"Our fourth quarter business was supported by the continued strong ramp of our industry-leading 3-nanometer technology," said Wendell Huang, VP and Chief Financial Officer of TSMC. "Moving into first quarter 2024, we expect our business to be impacted by smartphone seasonality, partially offset by continued HPC-related demand."

To put TSMC's N3 revenue share ramp into context, we need to compare it to the ramp of the foundry's previous-generation all-new node: N5 (5 nm-class), which entered high-volume manufacturing in mid-2020. TSMC began to recognize its N5 revenue in Q3 2020 and the production node accounted for 8% of the company's sales back then, which totaled $0.97 billion. In the second quarter of its availability (Q4 2020), N5 accounted for 20% of TSMC's revenue, or $2.536 billion.

There is a major catch about TSMC's N5 ramp in 2020 that muddles comparisons a bit, however. The world's largest contract maker of chips sold boatload of N5-based system-on-chips to Huawei at the time (shipping them physically before the U.S. sanctions against the company became effective in September, 2020) as well as Apple. By contrast, it is widely believed that Apple is the sole client to use TSMC's N3B technology due to costs. Which means that, even with the quick ramp, TSMC has fewer customers in the early days of N3 than they did in N5, contributing to the slower ramp for N3.

As for the entire year, N3 wafer revenue account for 6% of TSMC's total wafer revenue in 2023. Meanwhile, N5 revenue has finally overtaken N7 revenue in FY2023, after being edged out by N7 in FY2022. For 2023, N5 wafers accounted for 33% of TSMC's revenue, and N7 wafers were responsible for 19% of the company's revenue.

TSMC's fourth quarter revenue totaled $19.62 billion, which represents a 1.5% year-over-year decrease, or a quarterly increase of 13.6% over Q3 2023. Meanwhile, the company shipped 2.957 million 300-mm equivalent wafers in Q4 2023, up 1.9% sequentially. The company's gross margin for the quarter was 53.0%, operating margin was 41.6%, and net profit margin was 38.2%.

TSMC expects revenue in Q1 2024 to be between $18.0 billion and $18.8 billion, whereas gross margin is projected to be between 52% and 54%.

Source: TSMC

2 Comments

View All Comments

Dolda2000 - Sunday, January 21, 2024 - link

Would AMD products sort under "HPC"?ballsystemlord - Sunday, January 21, 2024 - link

For their CPU and GPU lines of products, yes.For their FPGA product lines, no.